Over at Technology 360, Dennis Haarsager points out that there's probably too much gloom-and-doom out there in the blogosphere regarding the future of various media platforms. He did phrase searches "to see how the media stacked up in the death department." He got back the following results:

> "death of television", 13,000 results

> "death of TV", 28,200 results

> "death of radio", 227,000 results

> "death of newspapers", 331,000 results

> "death of blogs", "death of the blogs", "death of the blog", 81,400 results

> "death of the web", 215,000 results

> "death of the net", 746,000 results

> "death of the internet", 1,910,000 results

No doubt---as Mark Twain might have said---the rumors of the death of media have been greatly exaggerated. And, as Mike Mansick of TechDirt points out, not all papers or media outlets are facing gloom and doom scenarios.

Nonetheless, many traditional media sectors and providers do find themselves in troubled waters today as tsunami of creative destruction tears through their markets. In our new "Media Metrics" report, Grant Eskelsen and I show how two sectors in particular---radio broadcasting and newspapers---are getting hammered particularly hard by a sort of "media perfect storm":

* loss of protected markets or "protected scarcity" = there's just no guaranteed audience anymore

* rapid technological change = the way media is created and transmitted has been completely transformed

* massive inflow of new competitors / platforms = no way to stop the deluge of new voices, including user-generated content

* loss of consumer confidence and allegiance = people have plenty of other places to turn their attention

* loss of advertiser confidence and allegiance = advertisers have plenty of other places to promote their goods and services (including direct-to-consumer appeals and 'word-of-mouth' marketing efforts)

* loss of investor confidence and allegiance = shareholders have lots of other places to invest their capital today

The results have been particularly grim for newspaper in recent months as various reports have noted.

Over at the "Reflections of a Newsosaur" blog, Alan Mutter has been tracking the bad news closely. Last Friday he noted how "7 newspaper stocks hit record lows in 1 day," and in a follow-up post this week he noted that:

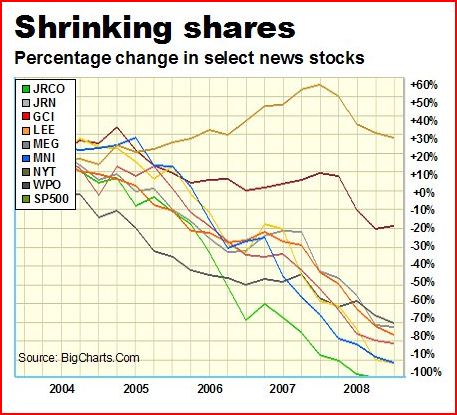

In a historic rout, newspaper shares have lost nearly $4 billion in value in the first 10 trading days of July, an amount greater than the combined market capitalization of all but the three largest publicly held publishing companies. The $3.9 billion plunge in the value of newspaper stocks since the first of this month - a period marked by successive new lows in the prices of several issues - has dropped the collective value of the following publishers to just $3.6 billion:

* A.H. Belo (AHC) today is worth $119 million, down 58% from $282 million when it began trading earlier this year as a free-standing newspaper publisher.

* GateHouse Media (GHS), worth $59 million, down 95% from $1.2 billion at its curiously strong initial public offering in October, 2006.

* Journal Communications (JRN), worth $266 million, down 78% from $1.2 billion on Dec. 31, 2004.

* Journal Register Co. (JRCO), worth $6 million, down 99% from $746 million on Dec. 31, 2004.

* Lee Enterprises (LEE), worth $145 million, down 93% from $2 billion on Dec. 31, 2004.

* Media General (MEG), worth $248 million, down 83% from $1.5 billion on Dec. 31, 2004.

* McClatchy (MNI), worth $387 million, down 93% from $5.7 billion on Dec. 31, 2004.

* New York Times Co. (NYT), worth $1.85 billion, down 67% from $5.6 billion on Dec. 31, 2004.

* Scripps (SSP), worth $522 million, which was newly launched as a pure-plan newspaper company on July 1, 2008. More details below.

* Sun-Times Media Group (SUTM), worth $32 million, down 98% from $1.3 billion on Dec. 31. 2004.

The only companies not on the above list are:

* Gannett (GCI), worth a bit less than $4 billion, down 79% from $18.5 billion on Dec. 31, 2004.

* News Corp. (NWS), worth $37.2 billion, down 36% from $58.4 billion on Dec. 31, 2004.

* Washington Post (WPO), worth $5.5 billion, down 24% from $7.3 billion on Dec. 31, 2004.

At today's close, the total decline in value of the dozen newspaper shares trading since the first of the year was nearly $27.7 billion, a plunge of 35.7% in 6 1/2 months. This calculation does not include the shares of Scripps, which dropped some $6.2 billion in value on July 1 after the company's non-newspaper assets were spun into a separate company. Counting Scripps, the aggregate value of newspaper shares dropped $10.2 billion since the first of this month. When you back SSP out of the calculations, you find that newspaper stocks have slipped $3.9 billion since July 1.

All I can say to this is Wow. Just... wow. These are stunning numbers, and if you need a graphic illustration of how much bleeding has been taking place, take a look at this chart showing newspaper stock drops over the past 4 years:

Just miserable. And it reminds me of the market cap chart that Grant and I put together for our Media Metrics book that compared Google's market cap to the market caps of the biggest players in the newspaper business (as of January):

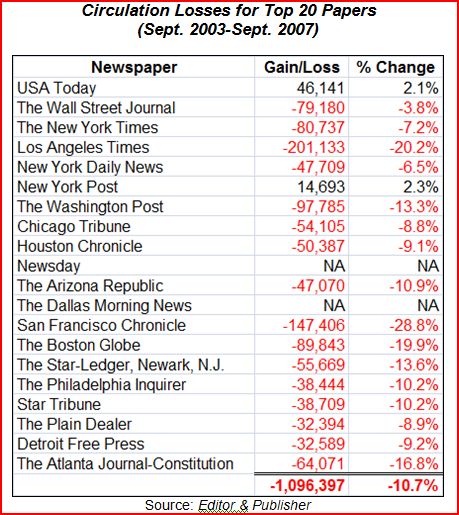

And, when you realize how rapidly newspaper advertising revenues are plummeting, you begin to understand why many analysts speak in gloom-and-doom terms about this sector:

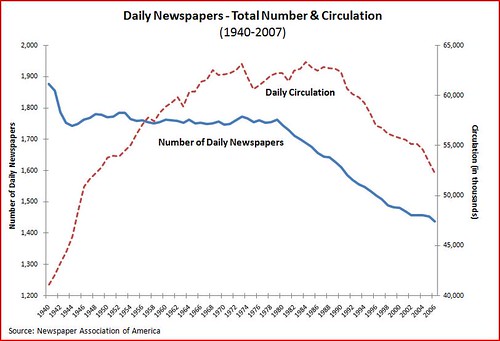

And daily circulation is falling rapidly overall...

Folks, there is just no getting around the fact that the newspaper sector is in serious, serious trouble. That's not to say that they'll all be going the way of the Dodo bird tomorrow. But many will die. Some potentially soon.

Others will reinvent themselves as online portals of hyper-local content and find new ways to connect with their readers. But hyper-localism can only get you so far, and things will never be like they were in the past.

If you want to read the absolute best analysis of where things stand today---and what the newspaper industry will need to do to re-invent itself in the face of this challenge---I highly recommend Terry Heaton's article about "Failure at the Top." It's must-reading on the subject. He argues:

To be sure, the paradigm of ad-supported content isn't going to go away. Media companies will continue to make good money from their own content, but it will never be the growth engine it once was. We simply must find another way, because the more advertising evolves without us, the harder it will be for anybody to sustain the kind of business we've known in the past, much less make it grow.

These are challenging times for those at the top of media companies big and small, and while we can easily point fingers of blame at culture, technology or a hundred other things, it's the responsibility of our leaders to rise to meet business challenges. The only failures that matter, therefore, are those at the top.

Make sure to read his entire article to see what he means by that and what he recommends to change it.

(In the meantime, it sure couldn't hurt for Congress or the FCC to give the newspaper industry a little regulatory leeway as it attempts to keep from drowning. The archaic regulations that continue to bind this sector are even more unjustifiable in light of the challenges described above.)